Scottish Business Monitor shows expected fall in activity and outlook

The latest Fraser of Allander (FAI) Scottish Business Monitor, published in partnership with Addleshaw Goddard, has noew been made available.

The survey was conducted over the period from April 1-8 2020, engaging with almost 500 businesses from across the Scottish economy, in both different industries and parts of the country.

The results provide an important indicator of activity within the Scottish business community, and their reflections upon the current crisis.

During what are unprecedented times, the public health crisis has hit the global economy and caused huge disruption.

The immediate priority is – of course – the country's health. Shutting down all but essential aspects of the economy is the correct policy response, not just from a health perspective but also an economic one. Investing in public health is a long-term investment in the health of the economy.

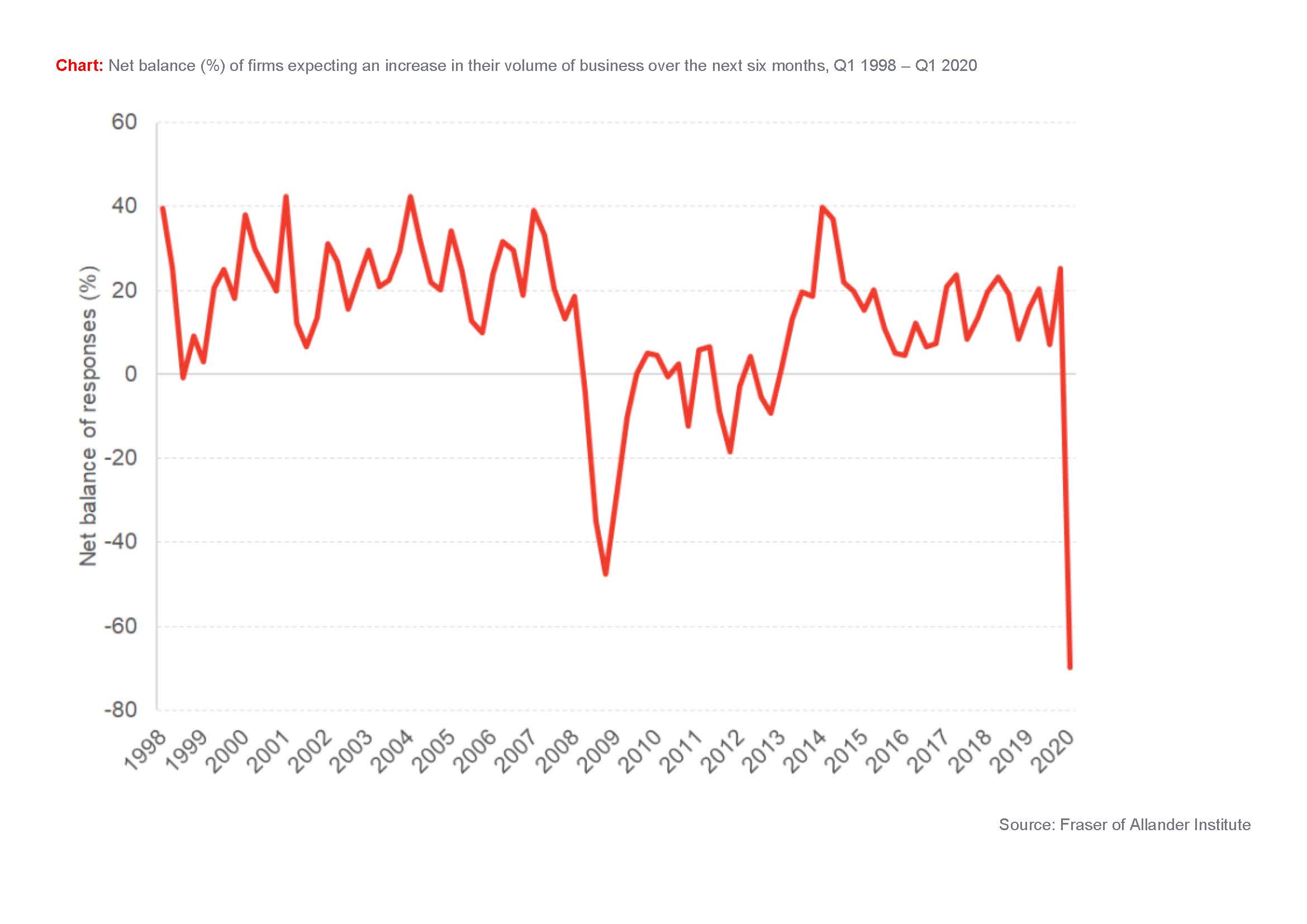

The FAI survey picks-up the scale of the shutdown, reporting, "It is extraordinary, with the lowest forecast for future activity amongst businesses that we have seen since the survey was first launched nearly 22 years ago.

"Of course, this means that many – indeed the vast majority of – businesses are finding conditions hugely challenging. Our survey shows that –

- The number of firms seeing an increase in their volume of business during Q1 2020 fell to its lowest level since Q1 2009. The outlook for the next six months is even more stark, as would be expected, with the outlook being the most negative since the survey began in 1998.

- When asked how long businesses could survive under current levels of trading, of those who responded to this question, 54% said less than three months while a further 32% said they could survive for four to six months.

- More than 95% of businesses who expressed interest in applying believe the ‘Coronavirus Job Retention Scheme’ being put in place has the potential to be very effective/effective in supporting their survival.

"Of course, there remain ongoing debates about how easy it is to access such support, and as with any new scheme – particularly one thrown together quickly – there will be operational challenges. This is something that we will pick-up in future publications of the responses from our businesses in future Business Monitor releases. But on balance, we find that businesses are – in principle – supportive of the key schemes announced by the government."

Key results

Over the first quarter of 2020:

- Our headline indicator – the net number of firms seeing an increase in their volume of business over the quarter – has fallen to the lowest level since Q1 2009.

- Similar pessimistic results can be seen across the board for turnover, the volume of new business, level of employment and new capital investment.

- All five of our sectors reported falls in the net number of firms seeing an increase in their volume of business over the quarter. Firms in the Manufacturing and Accommodation and Food sectors have the fewest firms reporting increases.

- Of course, it is the forward look that is most important here, given the likely contrast between January/February and March, when the lockdown measures began.

Over the coming months:

- 85% of businesses expect growth in the Scottish economy to be weak or very weak over the next 12 months.

- The net number of firms expecting an increase in their volume of business over the next six months has dropped significantly, with the outlook being the most negative since the survey began in 1998, with 10% expecting a rise in business, and 80% expecting a fall.

- This comes just after businesses had just started showing signs of more confidence. In the fourth quarter of 2019, the net number of firms expecting an increase in their volume of business was the highest it had been since the second quarter of 2014.

- The falls seen in the expected volume of business over the next six months are reported by all five of our sectors, but are particularly stark in the Accommodation and Food, Manufacturing, and Retail and Wholesale sectors.

- 60% of firms expect their level of employment to fall over the next six months.

- On average, firms expect wage costs to fall over the next six months, with the number expecting wages to rise falling from 72% in Q4 2019 to 27% in the current quarter.

- 80% of businesses state that credit availability over the next three months will be ‘very important or important’, up from 53% in the previous quarter. This is a reversal of a long-term trend seen over the last few years as credit availability has been less of an issue for businesses.

Read the full report here

Published: 9 April 2020